Estate Tax Repeal Helps Wealthy Famlies More Than Small Businesses By Taylor Raga

The estate tax is a tax that is assessed when property is transferred from the deceased property holder to his/her beneficiaries. The tax is triggered on estates with value that exceeds $5.45 million if owned by individuals, double for married couples.

Photo by Getty

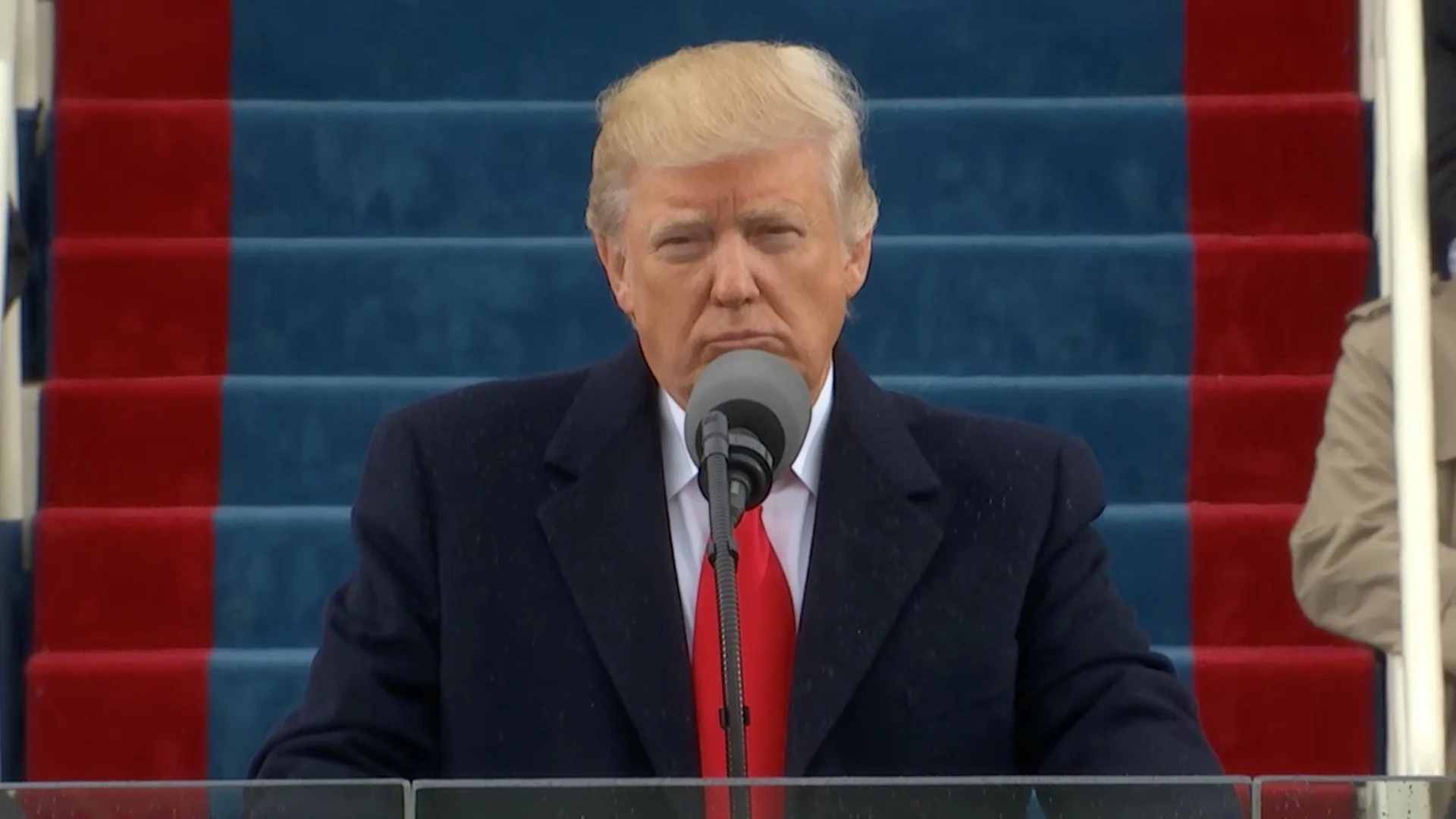

Republicans have relabeled the estate tax as a “death tax” and questioned the fairness and wisdom of taxing people upon their death. Donald Trump explained on the campaign trail that “American workers have paid taxes their whole life, they shouldn’t be taxed again when they die.” Trump also argued that this hurts small businesses and family farms.

Photo by Evan Vucci/AP

This tax impacts just a fraction of Americans. In 2013, 4,700 estates fell under this tax and only 20 small businesses. In addition to the $5 or 10 million trigger, the IRS allows for deductions and credits to be applied to the assessment, bringing down the top rate of 40 percent to an average of 17 percent.

The Tax Policy Center estimates that only 11,310 individuals who pass away in 2017 will have large enough estates to file this kind of return. Further, after deductions and credits are applied, only 5,460 will actually owe tax. Only about 50 of which will be small businesses.

A repeal of the estate tax will have no influence on the personal finances of Americans. The Joint Committee on Taxation believes only .02 percent of American estates will be impacted directly by the repeal.

At the same time, President Trump's children and his Cabinet are well positioned to benefit from the repeal of the estate tax. For instance, if Donald Trump’s net worth is $10 billion, as he has stated, his children would save nearly $2 billion. Bloomberg estimates that his actual net worth is more likely around the $3 billion mark, enabling his children to save $564 million.

Taylor Raga is a Research Assistant at The Utica College Center of Public Affairs and Election Research.